In Shakespeare’s Hamlet, chief counselor to the king Lord Polonius asked the protagonist what he was reading. Hamlet accurately, if imprecisely, replied, “words, words, words.” Counselors to asset allocators might ask the same thing of so-called “Fed watchers,” who dutifully interpret the US Federal Reserve’s Federal Open Market Committee’s (FOMC) meeting minutes. These minutes can help asset allocators and others understand the slightly delayed but more detailed views held by the Fed’s monetary policy decision makers.

Using NLP to quantify Fed discussions

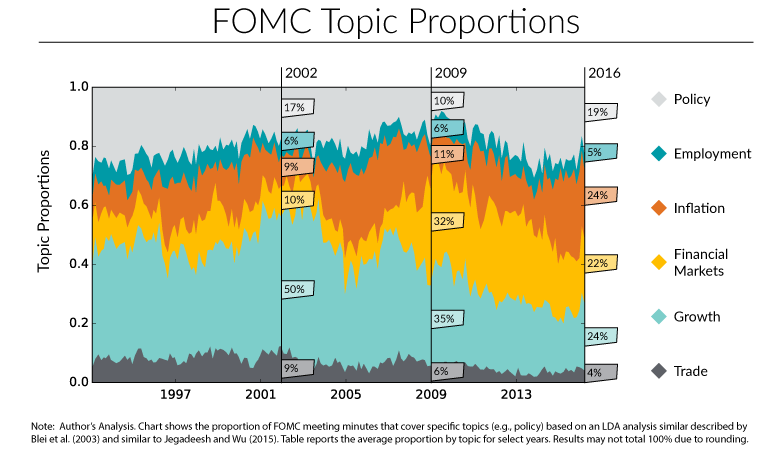

Historically, interpretations of those minutes required art, so Fed watchers pontificated and critiqued. Now natural language processing techniques can translate those minutes into relatively objective data. The results appear both intuitive and informative. For example, during the 2007-2009 financial crisis, the Fed increased the amount of time it devoted to discussing financial markets from 10 percent in 2007 to nearly 40 percent during late 2008.

At more recent meetings, the Fed spent approximately equal time (~20 percent) discussing inflation, growth, financial markets, and policy. Topics like employment and trade have commanded less than five percent of the Fed’s mindshare during 2016. Knowing what matters concern the Fed might help allocators sharpen their focus on the long-term issues that matter for both monetary policy and the broader economy.