At 8:30a.m. on March 6, 2015, the U.S. Bureau of Labor Statistics (BLS) released its employment report for the month of February. The nonfarm payroll count increased by 295,000, and the unemployment rate edged down to 5.5 percent.1Most economists would consider this good news. One consensus measure forecasted that nonfarm payroll employment would increase by a strong but relatively less impressive 235,000 workers, and the unemployment rate would drop to 5.6 percent.2 Despite the seemingly positive report, U.S. equity markets fell that day. By the 4:00 PM market close, the S&P 500 had declined 1.4 percent.

Many market commentators ascribed the loss to the persistent adage that “good news is bad news.”3 Good economic news, the self-conflicting logic suggests, increases the likelihood of the U.S. Federal Reserve tightening monetary policy sooner or more harshly (or by a greater amount) than the market currently expects. The resulting pressure on equity prices ostensibly outweighs the positive market effects of improving employment and economic growth.

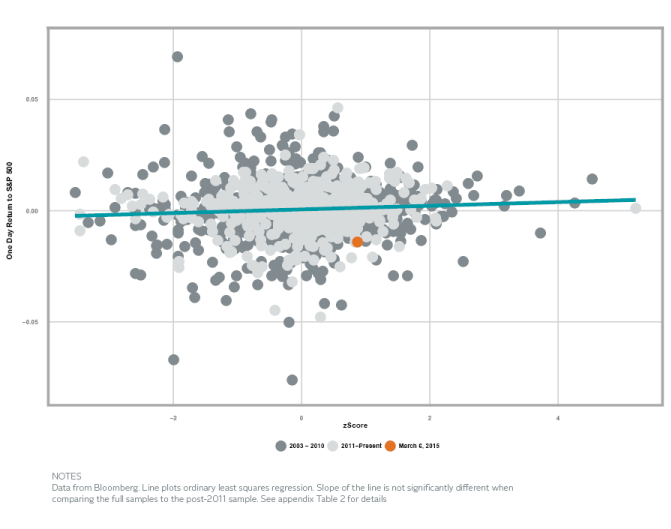

Like much folk wisdom, this adage seems more memorable than factual. Since 2003, “good” U.S. economic news has tended to correspond with positive equity returns. That relationship has proven statistically true over different time frames (e.g., when only evaluating data since 2011) and during periods of economic uncertainty (e.g., when future monetary policy is ambiguous). In other words, good economic news really is good news most of the time.