Catchphrases like “Big Data,” “artificial intelligence,” and “quantitative investing” have grown ubiquitous in the field of asset management, risking dilution of their actual meanings and significance. In May 2017, seeking to add greater clarity to these and related concepts, the Wall Street Journal published a series of articles and features called simply, “The Quants.”

David Siegel, one of our co-founders and co-chairmen, contributed an article to the series, in which he argues that, amid rapid changes in the industry, buzzwords ultimately matter far less than philosophy. His piece, “Quants’ Best Strategy Is From the 17th Century” is a tribute to understanding the world—and asset management in particular—through a scientific lens.

David argues that “The most effective way to address hard problems like forecasting asset prices or optimizing portfolios is…the same as for any other extraordinarily complex challenge: Use the scientific method.” Doing so, he points out, brings much-needed rigor to the process, while helping to counteract common but harmful cognitive and emotional biases.

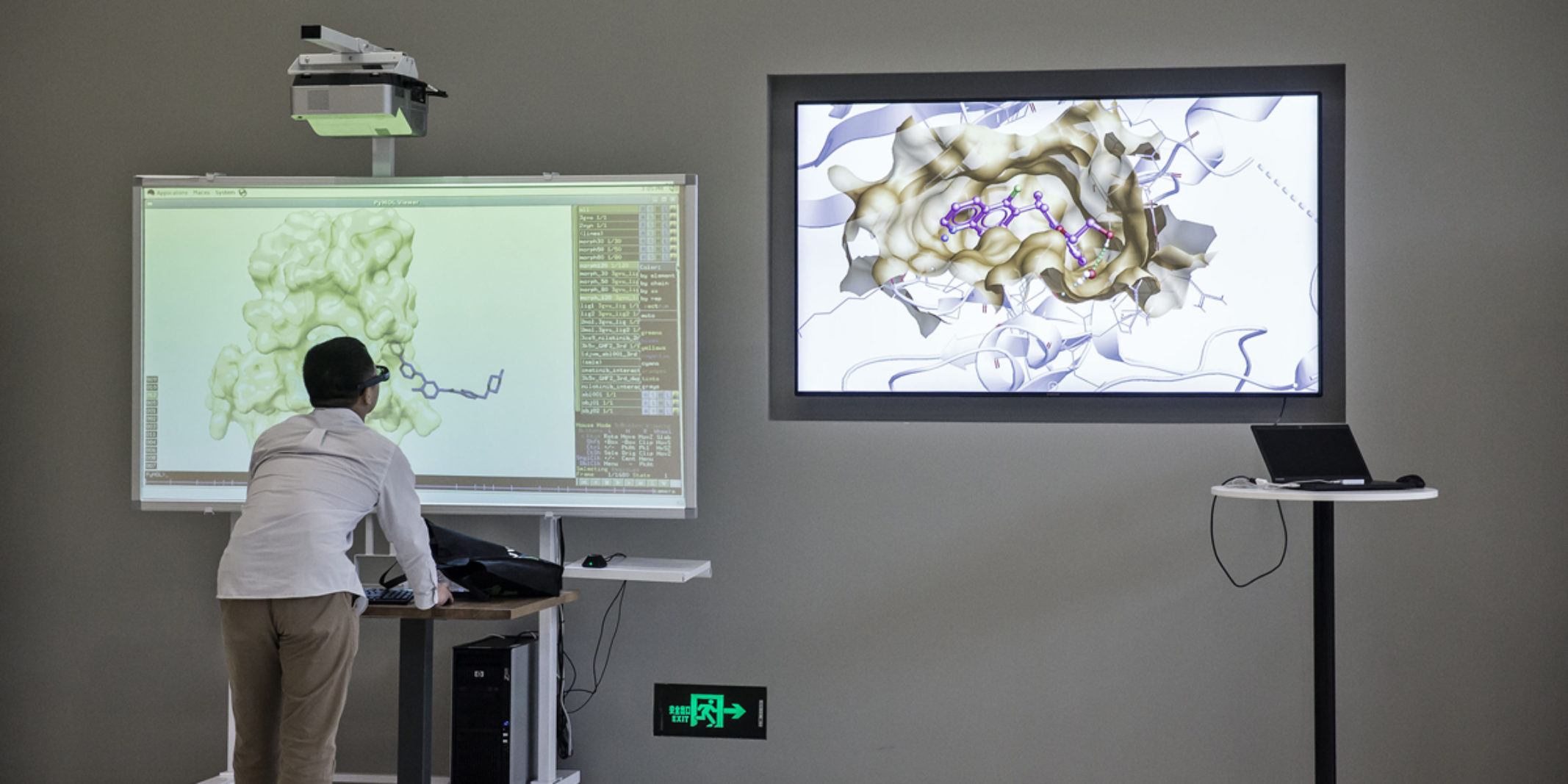

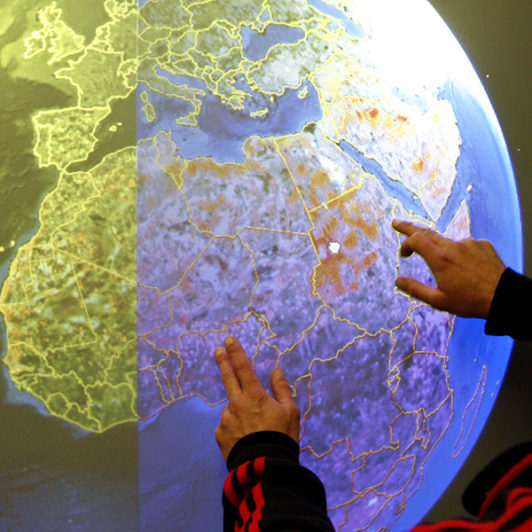

The availability of massive amounts of data and cutting-edge technology only magnifies the power of a scientific approach.

David Siegel, Two Sigma co-founder and co-chairman

While the advent of incredibly powerful technologies might seem to make it relatively easy to identify, collect, prepare, and find value in massive datasets, the opposite is actually true, he notes. Torrents of data and cutting-edge technologies only heighten the need to ground the entire investment process, from data ingestion to trade execution, on “the formulation of carefully crafted hypotheses, followed by a recurring process of measurement, learning, and adjustment.”

Ultimately, he concludes, the greatest beneficiaries of a more classically scientific approach to investment management are likely to be asset owners, whether they are individual retirees or large institutions.