The late, great yogi Yogi Berra, a quintessential American philosopher who also happened to play baseball, once said, “In theory, there is no difference between theory and practice. In practice, there is.”1

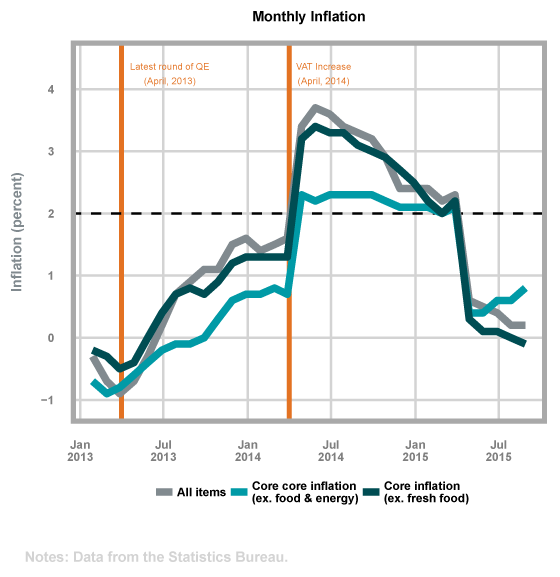

This Yogism applies to monetary economics. Nearly every theoretical model predicts higher inflation, or at least higher inflation expectations, when the central bank prints money. In practice, the Bank of Japan’s (BoJ) most recent experiment in quantitative easing has not yet lifted the Japanese economy out of its low-inflation trap. Japan’s Bureau of Statistics reported in September that core inflation for August fell to -0.1 percent.2 Expectations for future inflation, both from professional international forecasters and Japanese firms, have also trended down.

Why is Japanese inflation still so low?

Declining oil and other commodity prices explain some, but not all, of the disappointing inflation numbers. A more important driver might be the failure (so far) of the monetary and fiscal policy promises constituting Abenomics to fuel the takeoff needed for Japan to escape its low-growth, low-inflation equilibrium. Even long-term hopes for a less sclerotic economic environment seem to be fading. As Yogi more eloquently said, “The future ain’t what it used to be.”

The BoJ’s success or failure in achieving its goals matters to the markets for at least three reasons:

- First, and most obviously, Japan is the world’s third-largest economy, and its economic health affects global prosperity.

- Second, and more imminently, Japan’s struggle with inflation for the past three decades inspires the fears and informs the approach of central bankers in the U.S., Europe, and elsewhere. If the BoJ fails to realize its objectives, other central bankers may reevaluate their own approaches.

- Third, and most ominously, Japan’s inflation struggles may relate to changing preferences for saving and investment among an aging and shrinking population. This demographic challenge appears most acute in Japan but hangs like a Damoclean sword over the heads of policy makers in other developed, and some large developing, markets.

Perhaps Yogi, the seemingly perpetual optimist, would offer this advice to market participants and monetary policymakers in Japan and elsewhere: “When you come to a fork in the road, take it.”