By their nature, tail risks prove challenging to quantify. That does not present an excuse to avoid trying. As scary as many tail risks appear, it seems even more vexing to navigate through the proverbial dark without a flashlight, knowing that painful stumbling blocks abound but ignorant of their potential size and location. One approach to shine a little more light into the darkness is to gather perspectives from other navigators. In other words, tap the “wisdom of crowds.”

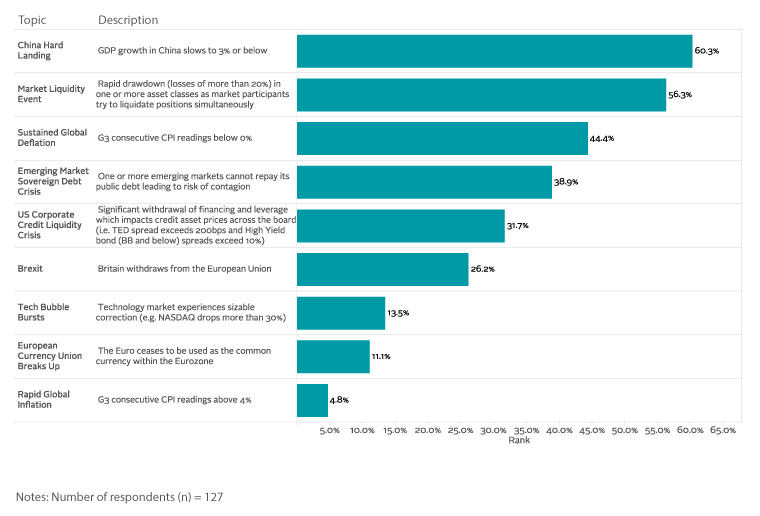

The sell-side professionals who contribute to Two Sigma’s Macro Alpha Capture platform constitute one such crowd. These individuals enjoy a unique perspective by sitting at the intersection of their organizations’ research findings and the feedback from their institutional clients. Two Sigma polled many of these macro specialists, and more than 120 responded with their estimates on the probability of nine different tail risks presented to them by the survey, as well as the expected timing of such events, and the probable effect on select asset classes.

Respondents in the survey rank a China hard landing (i.e., GDP growth of less than 3 percent per year) as 1.4 times more concerning than sustained global deflation, but these same respondents consider a market liquidity event as the most imminent threat during the next six months. Each of these nine tail risks could destabilize global asset prices, but the euro and emerging-market equities appear the most vulnerable based on the survey.

Most frequently selected tail risks