Some of Europe’s economic vital signs appear worse today than in March 2012, when Greece defaulted on its sovereign debt. Productivity growth during full-year 2015 fell to 0.8 percent per year from a persistently low level (average of 1.8 percent from 2010-2012). Policy uncertainty in June 2016 appears to have increased relative to the 2010-2012 average by nearly a factor of two.1 Growth and unemployment have improved slightly but remain depressed, and expectations remain low.

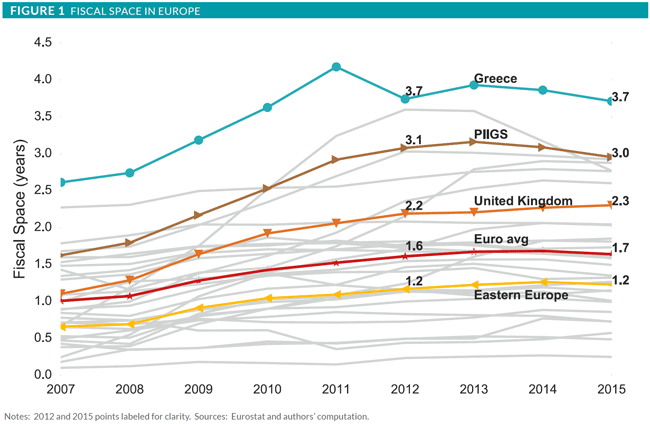

Asset allocators might not want to rely on policy makers to help nurse the economy back to health, at least in the near term. Average “fiscal space (FS),” a metric that tries to quantify European governments’ ability to offer fiscal stimulus, has deteriorated in the EU since 2012 (see Figure 1). If this trend continues, policy makers may have limited space to stimulate the economy and to absorb financial shocks. As a result, the market might expect higher credit default risks that further stress Europe’s economic health, creating a deteriorating cycle. Brexit represents an additional symptom, and its sudden appearance makes Europe’s health appear more acute. However, Europe’s sickliness extends well beyond Brexit.