By their nature, uncertain macro events pose risks to investors. It may seem vexing to quantify their likelihood, but that does not mean it’s not worth the effort. To minimize the complexity of this problem, Two Sigma recognizes the value—and sometimes the wisdom—of a well-informed crowd. The sell-side professionals who contribute to Two Sigma’s Macro Alpha Capture platform constitute one such crowd. These individuals enjoy a unique perspective by sitting at the intersection of their organizations’ research teams, and the feedback from their institutional clients.1

Two Sigma surveyed many of these macro specialists about the market-related event risks that concern them. More than 125, a subset of the full panel, responded between September 26 and October 5. Chief among their concerns is a loss in central bank credibility.

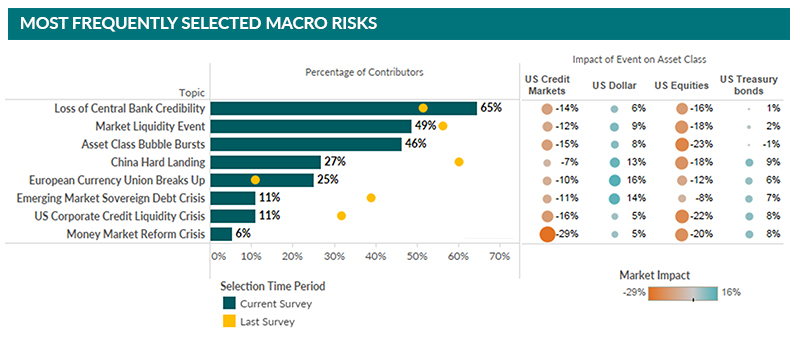

Ranking the risks: which risk events present the greatest concern?

Among respondents, 65 percent worry about the loss of G3 central bank (i.e. the Fed, BOJ, and ECB) credibility, defined as the ability of those banks to influence economic growth and market prices. This concern has increased more than ten percentage points since a year ago, perhaps in response to another year of observations about developed market monetary policy. The G3 banks continue to wage a protracted battle to encourage growth amidst low inflation and sluggish economies. For example, the Bank of Japan announced in early September plans to overshoot its previous two percent inflation target, with a focus on long-term government bond yields. For its part, the ECB has pushed interest rates below zero to boost the tepid one percent inflation rate. Many wonder what the Federal Reserve will do in the face of conflicting signals about the health of the U.S. economy and inflation.

Respondents cited the upcoming money market reform as the least concerning risk. Fewer than six percent of respondents selected this event as a concern, but they worry it is both the most likely to occur (47 percent probability) and the most imminent (9-month timeframe).2 Survey respondents might believe that the market has already adjusted to the U.S. money market regulatory reform. Since the beginning of 2016, prime money market fund assets have fallen by half as money flowed to government and retail money market funds.

Several other changes in macro event risk warrant notice. A China hard landing and an emerging market sovereign debt crisis, while very concerning to respondents in January’s survey, no longer appear high on respondents’ list of concerns. Conversely, the risk of a European currency union break up has increased more than two-fold since the last survey in January. Brexit likely fuels some of that concern.

Sizing the effects: how will the risk events affect markets?

While survey respondents seem to fear a China hard landing and EM debt crisis less, they harbor concerns that EM equities may prove especially volatile after strengthening 20 percent in 2016 (after sliding the same amount in 2015). Respondents predict 20-30 percent declines in EM equity returns should any of these macro events transpire. Other non-U.S. developed market equities seem just as vulnerable. Respondents expect only slightly smaller declines in those equity markets. Energy markets also appear vulnerable.

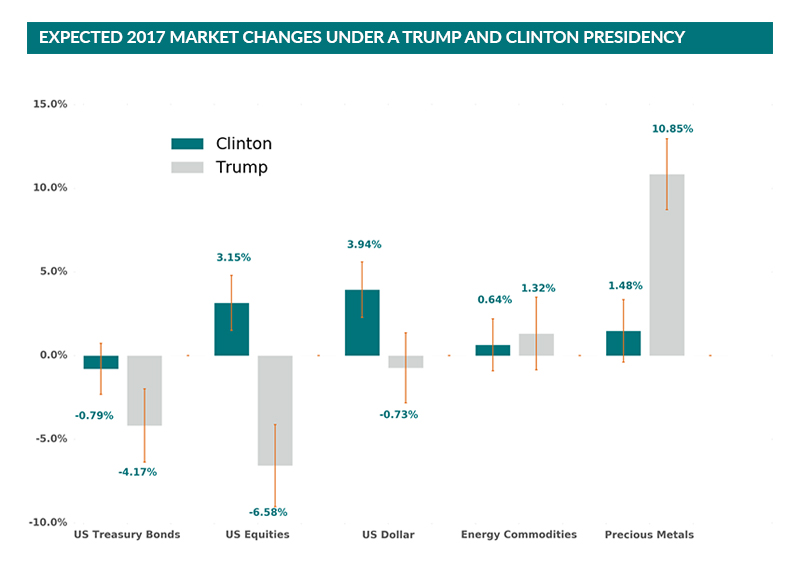

The US presidential election 2016

The survey also sought to explore the perceived importance of the upcoming U.S. election on the markets. Survey respondents believe that the difference in asset class returns between a Hillary Clinton and Donald Trump victory might amount to three to ten percent during 2017, depending on the asset class.3

The absolute return levels reflect participants’ belief in a “flight to safety” if Donald Trump wins in November. According to survey respondents, a Trump victory could herald a ten percent gain in precious metals, but a five percent loss in U.S. equities and a four percent loss in U.S. Treasury bond prices. Conversely, if Clinton wins, respondents expect U.S. equities (+4 percent) and the US dollar (+5 percent) to strengthen. The expected change to other asset classes did not show statistical significance.

Since market returns during 2017 will likely stem from factors beyond just the U.S. presidential election, the relative difference in market expectations between a Clinton or Trump victory may prove more insightful. Relative to a potential Trump presidency, respondents believe that U.S. Equities (+10 percent), the U.S. dollar (+5 percent), and U.S. Treasury bonds (+3 percent) will all strengthen more, or fall less, during the first year of a Clinton administration. The positive correlation between equities and fixed income may seem counterintuitive to some, though political pontificators might point to the candidates’ statements about both the Federal Reserve and the value of honoring U.S. sovereign debt as a potential explanation. Consistent with that argument, respondents posit that a Trump victory would strengthen precious metals (+9 percent) like gold more than a Clinton win.

Implications

Investors face many challenges when allocating assets for the long-term, particularly when trying to quantify the market effects of idiosyncratic events. Trying to compile a 360 degree perspective on the markets, using traditional and non-traditional sources of information like the wisdom of a well-informed crowd, might help. It is our hope that this Street View provides an additional, but certainly not a definitive, lens with these survey results.

Please download the full PDF of this Street View for the Two Sigma Macro Event Risk Survey’s methodology and other summary statistics.