When your wants overlap with the wants of others, you are in some sense inextricably linked. Linked in the mundane sense that you both want the same thing, but also in a deeper sense that forces you to actually mimic their emotions and even their actions.

How many of us waited in long food lines at the supermarket in early March as the world came to grips with the coronavirus pandemic’s global spread? Why were you waiting in those food lines? Did you independently come to the conclusion that your family was at risk of starvation if you didn’t rush to the market? More likely, you saw or heard about other people heading to the stores and intuitively you figured “well we better stock up too.”

You want food, other people want food. There very likely is enough food for everyone, but do people trust that others will behave rationally and show restraint to buy only what they need, or are they fearful that others may look to hoard as much as possible? If others are rushing to get food, then you need to rush to get food. As long as we all want the same things, we are all emotionally linked.

A good example of this phenomenon in the financial world is a bank run. You have money in the bank, other people have money in the bank. Regardless of whether you independently feel that the bank has solvency concerns, if others start panicking about the bank’s solvency, then in a very real way you need to start panicking too. You need to panic because if others withdraw their money from the bank, then the bank may truly become insolvent, so you need to withdraw as well, hopefully before they do. In a completely rational way, you are forced to mimic others: you are forced to panic.

Whether at the grocery store, the bank, or in financial markets, panic can be sparked by multiple people desiring the same resource (food, cash, safety). There is certainly a logic to these desires: securing food in bulk is a good idea in a pandemic, the bank really doesn’t have enough money to pay all depositors. But the dynamics favor first movers, which leads to participants leering at each other in a circle of mutual distrust, trying to discern if anybody else might jump–so that they might jump first. And as soon as somebody flinches, the run begins. This is an example of a prisoner’s dilemma,1 the classic example of this dynamic in game theory, where the very anticipation and fear of what others may do alters the optimal choices of each player individually. Anticipating the panic of others will often lead all players in a prisoner’s dilemma to panic themselves.

Financial panics are a specific category of panic that are obviously relevant for investors. What are the mechanics of financial panics? There are two key concepts: constraints and diversification. Let’s go through them and build up a model for how panics can occur.

Mechanism 1: Constraints

The first concept is constraints. Constraints are limitations or restrictions that may get in the way of otherwise optimal choices. Many of the features we will delineate are desirable or even add more flexibility in normal times. They only manifest themselves as constraints when stressed conditions surface. Leverage and liquidity are good examples.

Leverage

Taking leverage first: in normal conditions, leverage allows portfolios to be more flexible and less constrained. Leverage gives long/short equity managers the flexibility to tune their books to the desired size, and add securities without resorting to exiting positions in other parts of the book to fund those purchases. The entire concept of risk parity relies on using leverage to scale up exposure to lower volatility asset classes (in most cases fixed income) to match the volatility of higher volatility asset classes (in most cases commodities and/or equities). Managers also use leverage in basis trades, convertible arbitrage, and the list goes on.

When financial conditions become stressed, commentators often focus on “leverage” when they are talking about weakness in the financial system. As we will see, leverage can become a source of weakness because it suddenly morphs from a flexibility-enhancer into a constraint for those employing it. During market shocks this sudden switch can lead to panic and a cascade of liquidations.

Start with an external shock to markets: Coronavirus fears send equity markets downwards and demand for safe havens like Treasurys upwards. That’s not a panic, even if the size of those moves is substantial. It’s just a rational move driven by the anticipation of economic damage from a global pandemic. However, things cascade from there, and the initial risk aversion leads to even more selling, or “unwinding” in financial parlance. The unwinding process can quickly snowball, as we’ve seen in recent weeks. Trading floors, chatrooms, and blogs become a hotbed of gossip about unwinds: who’s unwinding? Did you hear firm X is unwinding? There was a big unwind today.

What causes unwinds? As we’ve stated, one explanation is constraints. Constraints may cause a market participant to feel forced, or actually be forced, to unwind their portfolio, even if they don’t believe it’s the best move from an “optimal” long-term perspective.

Let’s use the above example of leverage. If you are levered and your portfolio takes a large mark-to-market loss, you might receive a margin call. If your losses continue, you get additional margin calls and, eventually, one you can’t meet. You have to sell your position (or your broker does it for you), even if you think it’s going to rebound.

Even in the case where your losses are modest, you fear additional losses in the future and look to reduce your positions and leverage to avoid future margin calls.2 If you were not levered, you would not be as constrained in your decisions; you might choose to hold onto your investments from a more stable footing. Where leverage once enabled flexibility, it now has the opposite effect of a pernicious constraint.

Liquidity

A second constraint is liquidity. Asset managers provide investors with various degrees of liquidity in their funds to get their capital back. In normal times, liquidity is a highly desirable characteristic for investors, and it factors strongly into the decisions of where institutions place their money. For mutual funds, access to capital is daily and redemption proceeds are determined based on the net asset value at the close of that day’s markets.3 More complex investments such as hedge funds may have weekly, monthly, or quarterly liquidity with varying notice periods.

If a manager anticipates a large redemption, it will need to sell the securities in its portfolios to raise cash. The constraint of having to return cash to investors can force the hand of portfolio managers in ways that do not align with the fundamental views they would otherwise adhere to, especially if there is a mismatch between the liquidity provided to investors and the liquidity of the investments held in the fund. In the latter case, the manager may choose to sell the most liquid assets to raise cash, knowing less liquid positions may be even more challenging and punitive to exit.

Even institutional asset owners that structurally have multi-decade horizons, such as endowments, foundations, and pensions, have ongoing liquidity needs for spending obligations, quarterly reporting requirements, or board pressures. Many college and university endowments, established to support their schools’ operating budgets, may need to raise cash, as they will be unable to cut spending despite recent losses incurred. Pension sponsors may face the reality of challenging contributions to their defined benefit plans, as revenues shrink for corporations and governments (due to tax receipt declines), which increases the need to raise cash to pay necessary retirement benefits.

For example, in Australia, whose superannuation fund industry is one of the world’s more admired retirement systems, the government has recently permitted those under financial stress to access up to A$20,000 from their pension savings4–another potential need to raise cash. In all of these cases, there are scenarios where managers of funds must anticipate redemptions regardless of their performance, if their funds offer better access to capital than others. Again, an example of a feature, liquidity, which during most times is highly sought after, morphs into a constraint.

Risk guidelines

Finally, a number of hedge funds operate multi-manager platforms to deliver a diversified array of skill sets and investment styles to their investors. These teams may operate fairly independently from one another in the hopes that competition and economic incentives will reinforce a survival-of-the-fittest mindset.

A feature of such platforms is often tightly implemented risk limits on the various investment teams, in an attempt to maximize diversification (you don’t want all of the teams expressing bullish healthcare bets at the same time for example) and to limit the downside of underperformers. It is common to see rules in place where a team’s capital allocation is cut by specific percentages at certain loss triggers. For example if the portfolio is down 5% it needs to reduce in size by 20%, at a 10% loss the book needs to shrink by 50%, and a 15% loss the portfolio is liquidated and the team fired.

During extreme market conditions, some portfolios (say, fixed income relative value) may experience meaningful mark-to-market losses, but no matter how much conviction one has that these trades will rebound and losses will be recovered, the risk constraints will force the portfolios to be cut during this drawdown and unable to participate if/when the markets normalize. Indeed the very anticipation of hitting those loss thresholds may lead portfolio managers to cut positions themselves, rather than wait until they are up against more rigid risk limits.

A weakness cascade

Summarizing, market panics force constrained players to unwind, whether due to leverage, liquidity, risk guidelines, or other external or internal pressures. They simply can’t take any more losses, so they do something they may not believe is the right move in expectation: they unwind. This selling pushes prices down further, and eventually pressures the next layer of constrained players to unwind. And they also unwind, forcing the next, and so on down the line.

Unwinds in this framework occur in the order of constraints, often eventually impacting even those with the strongest track records, soundest liquidity terms, and best governance: a weakness cascade. Now, this doesn’t mean all selling pressure or event unwinds are caused by constraints: some managers truly do have quite strong fundamental views that would cause the same set of decisions, or perhaps find the market conditions so unusual that they prefer to not express any significant view until normalcy resumes, but constraints are an often overlooked driver of market panics that warrant attention.

Mechanism 2: Diversification

Let’s now bring in our next concept: diversification. Normally a desirable force that reduces risk concentration, diversification plays an interesting role in panic mechanics, in that it can cause panics in one market to spread to other seemingly unrelated markets. For example, in March and April of 2020, large moves in macro assets such as equities, fixed income, and oil have been followed by large shocks to equity market neutral factors such as low risk, size, and short term reversal.

What could link equity and oil prices with market neutral style factors? One linkage is that big, diversified players have exposures to many strategies in their books, across the entire smorgasbord of alpha- and beta-generating capabilities. If a big, diversified investor is weakened by performance in one of its books, that can spell trouble for other, unrelated books via two channels: one mechanical and one behavioral.

Diversification and forced unwinds

First, a diversified manager may mechanically unwind one part of their book in connection with funding losses or making “readjustments” in risk exposure across their broader portfolio. For example, a manager may suffer large losses on long oil positions, forcing it to unwind other positions to rebalance its portfolio risk or to strengthen its overall cash position: perhaps the manager unwinds other energy positions that had been expected to hedge the losing oil trade. These adjustments put pressure on other managers that might hold positions in these newly affected markets, even if they had none of the original oil exposure that sparked this sequence of events. Expand this to a larger number of highly diversified portfolios, each with some degree of direct and indirect overlap (and often each employing leverage), and the situation can get quite challenging indeed.

Unwinds can spread even across asset classes. During the 2007 quant crisis, many speculate that long/short equity books were “raided” for cash in order to fund losses in macro-related books.5 Throughout March of 2020, we saw losses incurred by managers with exposure to risk assets like equities and energy potentially lead to dramatic moves in fixed income markets. These moves were not simply parallel shifts in the yield curve, but rather consisted of changes in the steepness of the curve, differences in yield changes across typically correlated markets, and even breakdowns of usually stable relationships among Treasurys, bond futures, and interest rate swaps (all theoretically anchored to the same fundamental rates).6

An example: in normal times a fixed income future and the cash bond that underlies it are linked very tightly. This is intuitive since one instrument is more or less a derivative placed on the other. However, in stressed times, liquidity becomes paramount, and the cash bond is suddenly an illiquid cash hog relative to the liquid future, and the two instruments are no longer similar along the relevant dimension (liquidity), and thus are effectively not similar at all. The relationship is shattered, and the basis blows out, causing pain that is almost untraceable to its original source (the coronavirus pandemic).

Why did these typically tight relationships break down? The cash/futures Treasury basis, for example,7 does not seem at first glance to be fundamentally connected to the coronavirus pandemic. These relationships break down because they are economic relationships tied to fundamentals that hold over the medium to long term, when all players are strong. When weakness emerges in other parts of a diversified book (again due to direct exposure to the pandemic), leverage reduction and liquidity creation are at a premium, and relative differences in those newly relevant attributes (liquidity and leverage as opposed to fundamentals) become pivotal.

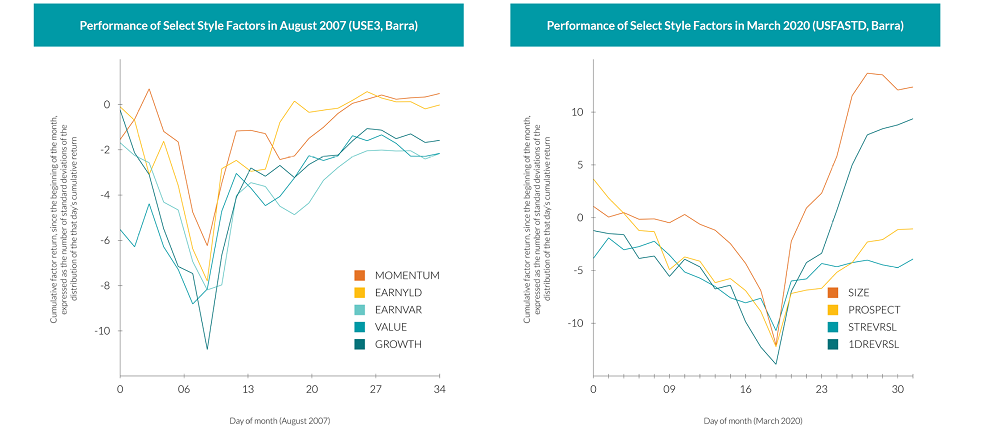

In another recent example, long/short equity portfolios appear to have gone through a significant amount of deleveraging in March of 2020, akin to the “Quant Quake” of August 2007. As mentioned above, one theory underpinning the August 2007 incident was that multi-strategy funds suffering losses in their macro books raised cash by unwinding their equity market neutral books.

Back then, slow-moving, crowded factors, such as value and growth, suffered large drawdowns. This time, faster, traditionally high-Sharpe factors, such as short-term reversal, were hit hardest, with magnitudes equal to or even greater than the worst seen for the slower factors in 2007. Higher-Sharpe factors are typically traded with more leverage, since players are more confident in their performance, and this may have exacerbated the unwind.

In both 2007 and 2020, performance had mostly recovered by the end of the month in which the drawdowns occurred, but of course this was little consolation for those that unwound and weren’t able to participate in the recovery. Pundits will surely debate the catalyst for liquidations in March 2020, but it would not be surprising to see, once again, how diversification may have contributed to cascading unwinds.

All of this means that during an often chaotic set of market dislocations, highly diversified managers begin to look like a series of circles in a Venn diagram, with a number of even small overlapping exposures creating a series of events that can impact those appearing to be operating without any direct overlap to the original source of pain.

“Preparing to panic”

The second channel through which diversification transmits panic is more behavioral than mechanical. If a diversified manager suffers large losses in one part of their book, they know they would be too weak to survive an unwind spiral in another, unrelated, part of their book. Knowing this, they may think they need to unwind their unrelated book now, even though nothing is wrong with it, rather than wait until it’s too late.

What’s more, other, stronger players may be able to predict this reasoning from the weakened players, and they can “guess” that mechanical unwinds like those detailed above will occur. If you hold a cash/futures bond basis position and see equity markets crash, you may intuit that that will cascade to your basis position via diversified players, even if you were not directly impacted by the equity crash at all. The mutual circle of mistrust of a bank run or food panic develops, and even strong players may try to get ahead of such unwinds by unwinding themselves first, from a position of strength. They “prepare to panic” (see cartoon below), but preparation itself is unwinding some of their book, which itself can start the cascade.

Like leverage and liquidity, diversification is a useful financial tool in normal times that cruelly morphs into an exacerbating force during market panics. Two markets can never really be unrelated as long as there are players that hold exposure in both markets. Losses in one market generate mechanical rebalancing, grabs for cash, and overall weakness, which cause pressure to unwind in other markets, which causes losses there as well. Notably, similar to a bank run, none of this needs to actually be true, the run will happen so long as others fear it might be.

Conclusion

To sum up, we start with two relatively simple concepts that contribute to the mechanics of panics: constraints and diversification. Constraints are limitations or restrictions that may get in the way of otherwise optimal choices. Examples of constraints include leverage, liquidity, and even personnel structure. Diversification means that problems in one area of the market can lead to unwinds both mechanical and behavioral in other areas of the market. Throw in some game theory, and we can see that unwinds can occur at the mere speculation of vulnerability from others in the market, much like a bank run. Within short order, formerly staid and unrelated markets can turn into connected panic-zones.

It is important for asset owners and asset managers to build an understanding of these mechanics. To start, knowledge of how decisions in a panic may be forced by one’s own constraints, the constraints of the managers they hire, and others around them, is critical. Also critical is a grasp of how diversification can link different, and seemingly unrelated, sleeves of a portfolio. These concepts can serve as a framework for investors to assess why performance can be outside typical expectations during panic episodes. This context should be weighed alongside longer-term expectations in thinking about how best to allocate capital.