Among his many transgressions, the mythological Sisyphus earned the ire of the Greek gods for enchaining Death. In punishment for trying to upend the natural order, Sisyphus suffered an eternity of rolling a rock up a hill, only to see it tumble down each time.

Numerous other analyses of the Greek economy have drawn parallels to Sisyphus’ story, and for good reason. Multiple times during the past seven years, Greeks have struggled to scale an “economic prosperity hill” while managing a large debt overhang. Assistance from organizations like the IMF have (arguably) sought to help push Greece along, but the effort only seems to bring Greece closer to an unstable summit.

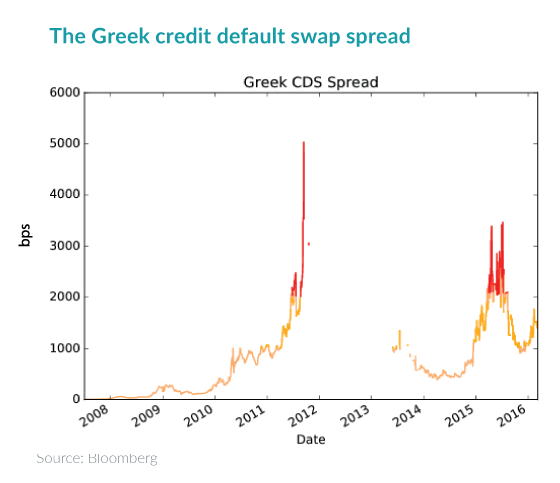

Greek CDS spreads are once again elevated

Greece once again finds itself approaching a hilltop. The Greek government boasted a primary budget surplus in January nearly 184 percent higher than the target it set in consultation with its creditors. Overall revenues exceeded target by 11 percent, and overall expenditures remained 15 percent below target. However, the rock could easily slide down the hill again.

The Greek government requires more support from the so-called Troika (EC, ECB, and IMF) to pay back an ECB loan maturing in July in order to avoid bankruptcy(1), and the IMF argues that Greece remains a “good distance away from having a coherent program” that the IMF would approve for further funding (2). Likely as a result of this uncertainty, Greek CDS spreads have approached a level (2000 bps) on par with last summer’s crisis. Asset allocators not directly exposed to Greece might still want to pay attention, as sovereign debt from the usual list of culprits (e.g., Italy, Spain, and France) continues to have relatively high correlations (>30 percent) to Greek CDS.