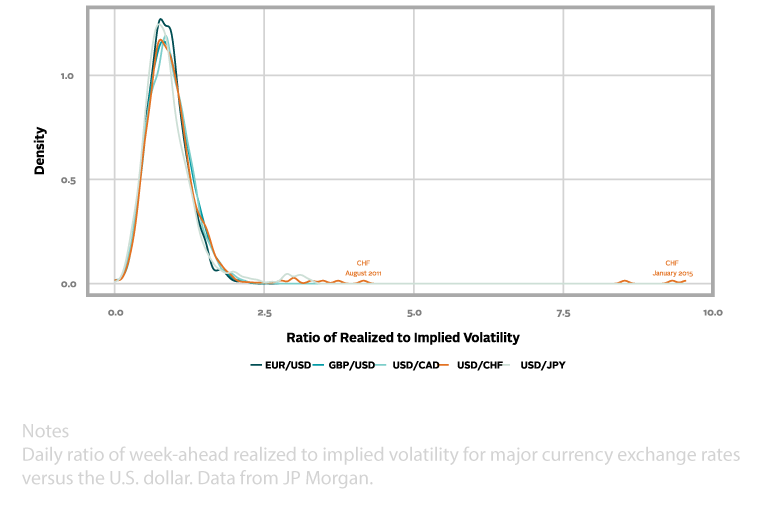

In one of the final scenes of the original Star Wars film, Han Solo describes Luke Skywalker’s coup de la mort of the Death Star as a “one in a million” shot (i.e., less than five standard deviations). By some measures, the recent appreciation of the Swiss Franc (CHF) appeared even less likely. The magnitude of the CHF move on January 15 doubled the magnitude of other developed market currency moves since 1990. The realized weekly volatility represented a ten standard deviation “shot.”1

Two possibilities exist that can explain the occurrence of such a statistically unlikely event: either the CHF move represented a fluke or the market mispriced risk for a pegged exchange rate. This Street View argues for the latter explanation and wonders what other risks associated with currency regimes the market might also underestimate. The Greek “peg” to the euro springs to mind.