Another summer has passed, leaving film critics yet another set of Hollywood blockbusters to cite when criticizing the industry for repetitive storylines and formulaic sequels. Market observers might level the same complaints about financial themes (and the market commentaries that describe them). For example, in September 2014, Two Sigma Street View wrote:

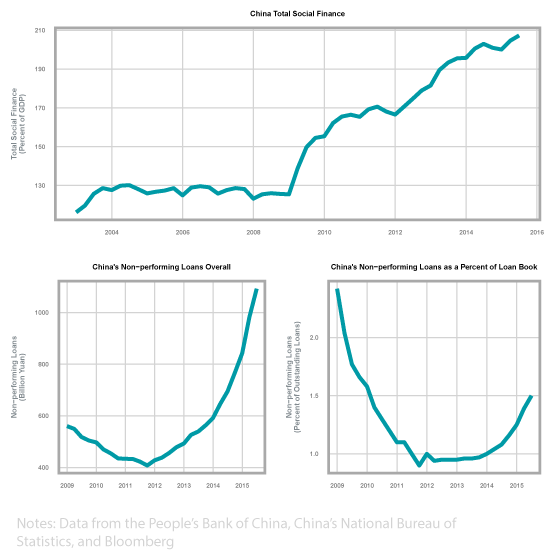

Investors may feel like they have already seen this movie: Financial institutions in a large economy issue credit at a historically unprecedented pace over multiple years. Borrowers initially feast on the plethora of opportunities created by supply-side structural changes (e.g., productivity growth, new resource availability, economic liberalization) and access to credit. The economy enjoys strong growth, particularly in a trendy sector such as real estate… Reality eventually hits… The economy slows. Depending on the year and setting, the movie typically falls under the horror genre, due to a large and sudden contraction causing massive economic upheaval, or the drama genre, due to the protracted but still sorrowful conclusion. Recent examples include the United States (2007-2009), the euro zone (2009-tbd), and, depending on the critic, Japan (1997-tbd)… For good reason, some argue that filming of a remake of this story may have already begun in China.

China’s next crisis may be a matter of “when” not “if”

One year later, it seems the story is indeed being re-told in China, with the risk of a systemic shock emanating from China’s financial sector reaching a new high. In the short-term, the Chinese market appears strong:

- China maintains large, though shrinking, foreign exchange reserves.

- Even if headline growth rates disappoint, China’s economic growth levels still warrant excitement.

- While the Chinese government’s reputation for crisis management may have lost its luster, the government has demonstrated recognition of the problem and a willingness to act.

Nevertheless, these very points remain a challenge for the country in the long-term – exhaustible foreign exchange reserves, slowing economic growth that stresses social order, and moral hazards from government intervention. Another installment in the “China financial crisis film series” may hit global screens again sooner or later. Whether that blockbuster comes next summer, or another time, remains any critic’s guess.