It’s the week of US Thanksgiving and many of us are planning our menus, confirming travel plans, and thinking of discussion topics that hopefully won’t end up in arguments. As a team, we took this opportunity to investigate some Thanksgiving-related food trends using open data. This is certainly not a novel idea; a quick search will reveal geo-tagged tweet maps and lists of the most popular recipe searches. And of course all you could ever want to know about turkey — to brine or not, to bake or fry?

Half of the Data Clinic team are vegetarians, which inspired us to investigate trends in plant-based Thanksgiving menus. We were interested in exploring the elusive and rare beast that is faux turkey, or as it is more commonly known, the tofurkey.

For the uninitiated, the concept of tofurkey (a linguistic blend of tofu + turkey) has been around for many decades and connotes a meat-free main dish alternative to turkey. But how many people opt for tofurkey on Thanksgiving and how has this concept evolved over time?

We began by trying to understand the number of vegetarians in the US, which is surprisingly hard to pinpoint. According to a few different surveys, approximately 3–5% of Americans identify as vegetarian, but that doesn’t include those who are vegetarian inclined. Nor does this describe major shifts in dietary/lifestyle preferences of younger generations. According to Economist reports, a quarter of 25–34 year olds say they are vegetarian. Are these macrotrends reflected on the Thanksgiving table, and is there data that can help us to uncover these insights?

The answer is, sort of.

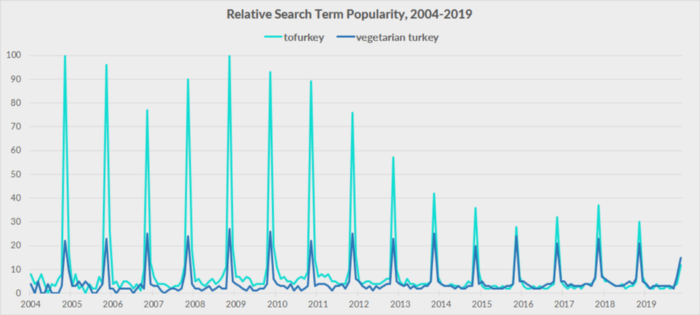

Using Google Trends, we downloaded the US search history for “tofurkey” and, sure enough, saw extreme jumps in search popularity every November right around Thanksgiving. Note that Google normalizes the data to indicate relative popularity of a search term for the time and region selected. For our results below, “tofurkey” in teal received the most interest in November 2008, but has been declining ever since. This is in slight contrast to the broader term of “vegetarian turkey” in blue, which looks to be fairly stable over time.

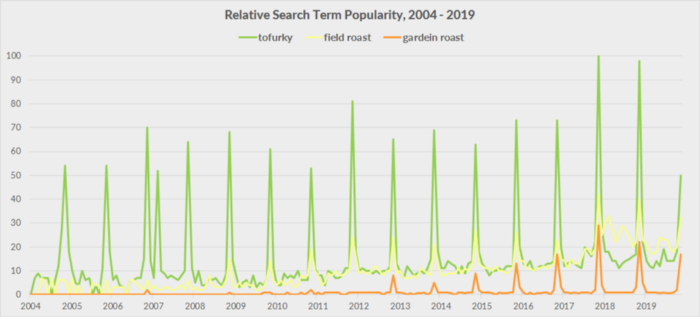

This would first appear counter to our expectations. As more people look to plant-based alternatives, why would search popularity for tofurkey decrease over time? However, if you’ve been feasting on faux meat roasts for Thanksgiving over the past two decades, as many on the Data Clinic team have, you might know that the concept of tofurkey has crystallized into specific products, each with their own popularity and branding. One such offering is Tofurky, a single letter away from tofurkey. Other well known products include Field Roast and Gardein meatless roasts.

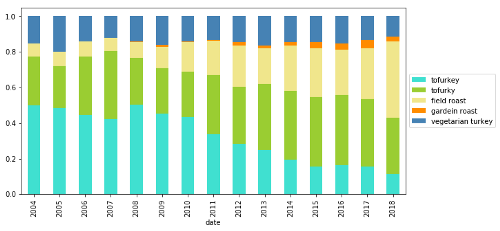

If we look at these specific keywords for the same time period, we see that the trend is now reversed, with popularity surging in November of more recent years. Another way to look at this visually is by year, using a stacked bar chart of relative popularity. Below, we can see that ‘tofurkey’ loses influence over time as people start searching for specific brands more often.

The data demonstrates that the concept of tofurkey may be losing momentum, while interest in specific types of tofurkey is growing. Now, we can’t say that this means that more people are serving plant-based roasts for Thanksgiving, but it does provide some insight into the evolving landscape of turkey-less turkey moving from the generic term to more specific products.

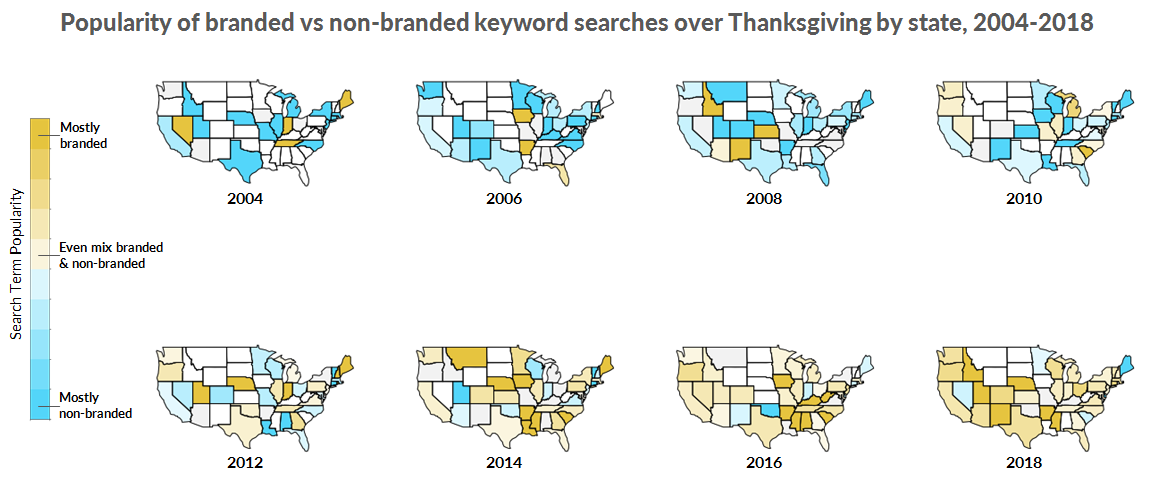

Another interesting angle is looking at geographic trends over time. If we group our search terms into brand-specific (Tofurky, Field Roast, and Gardein Roast) and general concept (tofurkey and vegetarian turkey), we can visualize how keyword specificity differs from state to state and how this has evolved over the years. We do this by calculating the percent of brand-specific versus general concept searches during Thanksgiving by state for each year.

States without much keyword search history for these terms appear in white; increasing popularity overall is reflected by a reduction in the number of these states. As expected, there is an overall temporal shift from more blue (non-brand popularity) in 2004 to more gold (brand-specific popularity) in 2018. We can also see that there are some pockets (e.g., the northwest) of early adopters of brand searching, but over time these clusters become less obvious.

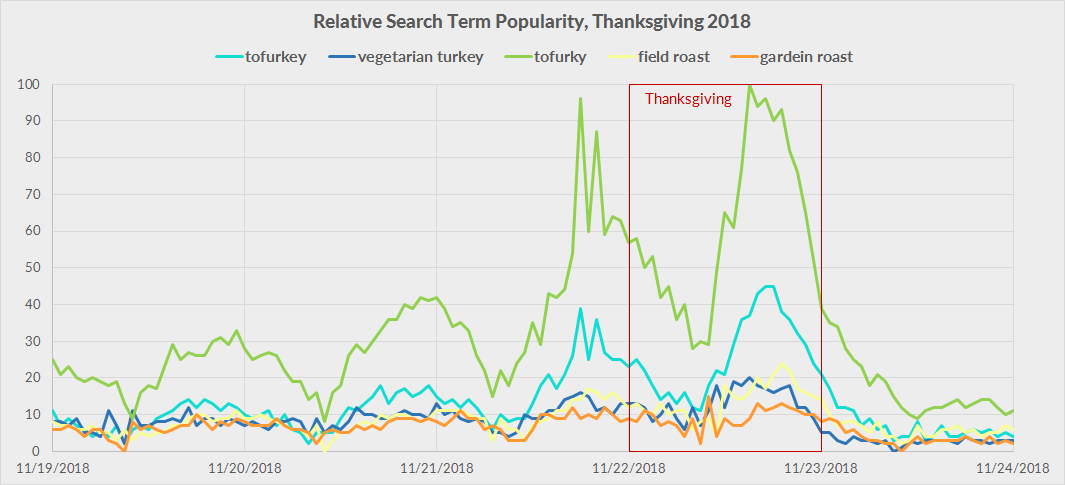

Now, just for fun, we wanted to investigate the time component of searches to see specifically when around Thanksgiving people are looking up tofurkey and its related terms. Below, we show hourly search trend data for Thanksgiving in 2018, including three days leading up to and one day after the holiday.

It appears that the evening before and evening of Thanksgiving are the peak search times for all included terms. We imagined there would have been a more gradual increase in search activity leading up to Thanksgiving, and as a team enjoyed speculating about why this wasn’t the case. A last minute panic search of what to serve the vegetarian guest you just learned was coming? A search to help you figure out how to tell when your meat-free roast was done cooking? An after dinner search by someone who wanted to know what they just ate? The possibilities certainly don’t end there, but our investigation does — it’s time to get cooking.

On behalf of Data Clinic, we hope you have a wonderful Thanksgiving, meatless or otherwise.