It’s been several months since we examined the potential impact of COVID-19 on Census self-response rates in NYC. Our findings revealed that higher income communities such as the West Village, Soho, Tribeca, and the Upper East Side in Manhattan were farthest away from meeting their 2010 response rates at the end of May. As the Census draws to a (contested) close, we were curious to see if this pattern held true in the current data.

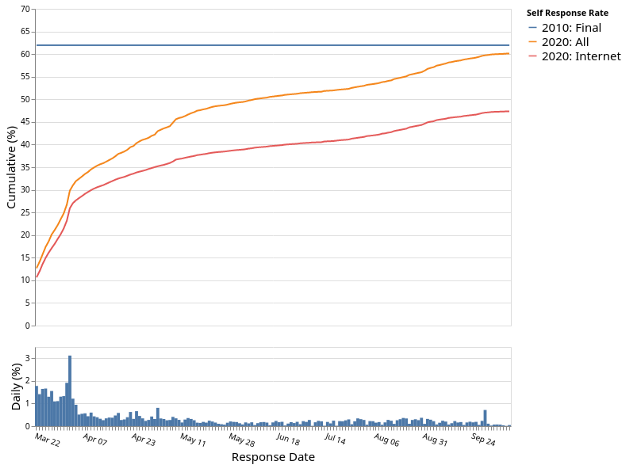

Using the same methodology as in our previous analysis (accessible in our GitHub repo), we compared the cumulative change in percent self-reporting for NYC (Figure 1). May 26 is marked with a horizontal line to indicate the date of our previous post.

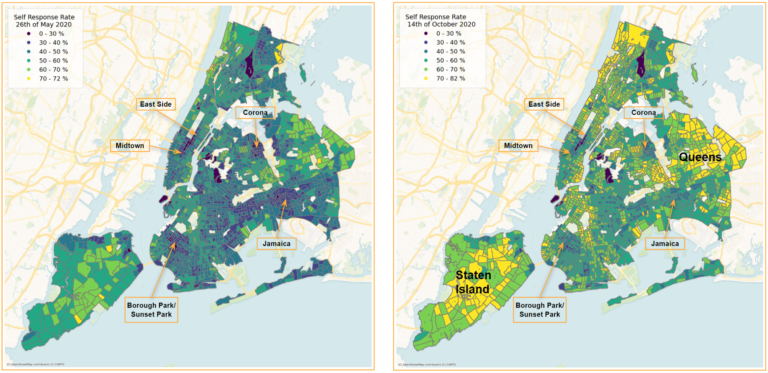

Although cumulative responses have increased over time, particularly for the mail in options, as of the time of this publication, the total response rate remained short of the 2010 final hovering just below 60%. Comparing rates across the city by census tracts (Figure 2) demonstrates improvements in response rate across most of NYC with large swaths of Staten Island and Queens reaching rates over 70% response rate. However, areas we identified in our previous post as having troubling rates (namely neighborhoods of the East Side, Midtown, Jamaica, Corona, and Borough Park/Sunset Park) have not made much progress and remain below the city average.

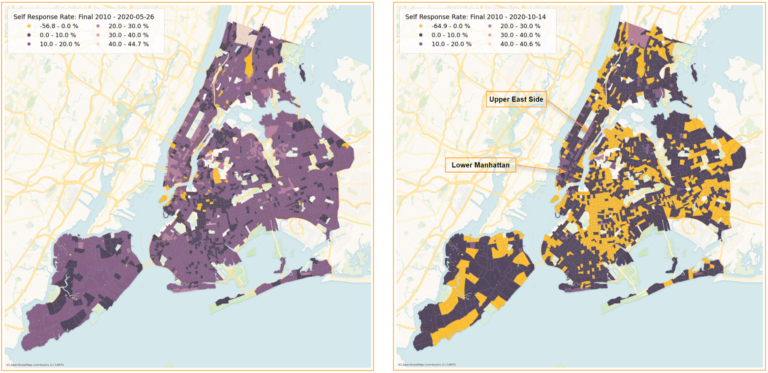

Once again plotting the difference in current 2020 self response rates to those of 2010 (Figure 3) provides an indication of how close tracts are to reaching or even surpassing their 2010 rate (in yellow). Comparing progress from May to now, we see a lot more yellow, especially in regions in Brooklyn, Queens, and Staten Island. In contrast, all but a few census tracts in Manhattan are still lagging behind their 2010 goal. This difference is the most extreme in Lower Manhattan and the Upper East Side, which have up to a 20% deficit.

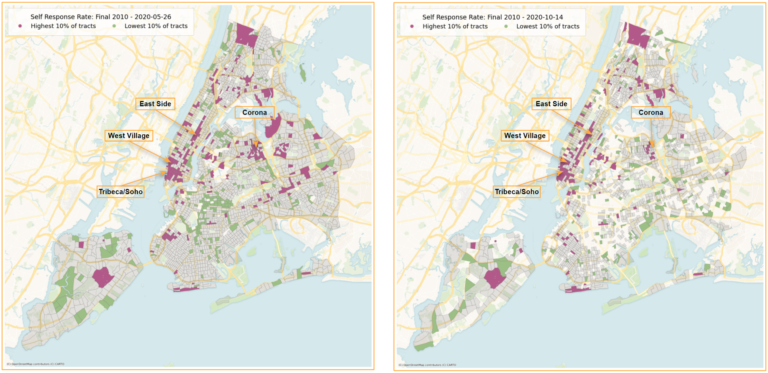

Looking further into extremes, Figure 4 displays census tracts with response rates farthest away (in pink) and closest to (in green) those in 2010. In general, there is not much change between May and now — wealthier parts of Manhattan (Tribeca, Soho, West Village, and the East Side) still remain areas of significant under-reporting. It’s hard to say why these parts of Manhattan have such low response rates this year though it certainly adds to the speculation that individuals in these neighborhoods, with the means to relocate to second homes, may have filled out their census at a different address or perhaps not at all.

In past years, in-person enumeration targeted neighborhoods with low self response rates but given the hypothesis that low engagement is caused by the exodus of people from these areas, it’s possible that the count will remain low.

While the exact date of the end of the census is currently being argued in a federal appeal court, the recent Supreme Court ruling effectively paused all census activities. Apart from NYC, widespread undercounts are apparent across the nation and these inaccuracies will further impact vulnerable communities for the next decade.