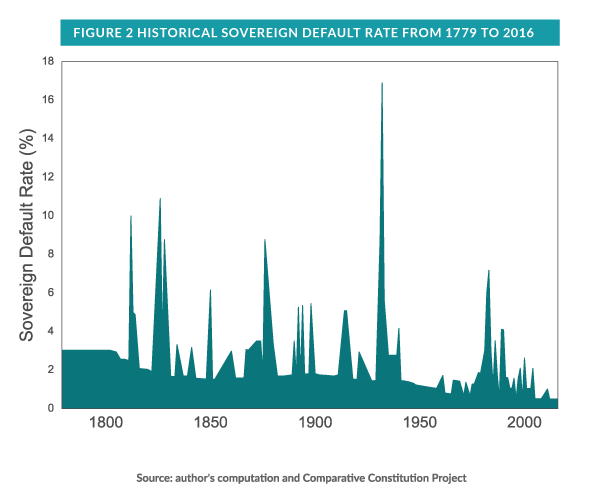

The collapse of sovereign capital markets in the 1930s saw a large number of European and Latin American countries default. In 1932 the sovereign default rate recorded a maximum of about 17 percent, compared to a historical average of 2.6 percent.¹ Among other factors, the lack at that time of any security to help protect investors against a sovereign default made the experience especially panicking.

As investors may have learned from past experiences, sovereign defaults are relatively rare. Since the beginning of the 2000s, investors have increasingly bought protection against sovereign defaults, in the form of credit default swap (CDS) contracts, an insurance market that was worth $1.9tr as of 2016H1.²

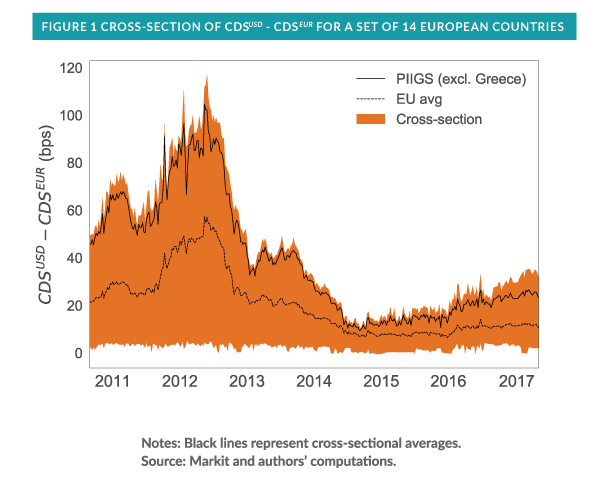

When the European sovereign debt market started showing signs of distress in 2010 due to governments’ interventions in financial markets, demand dramatically increased for CDS protection written in currencies other than the euro (Figure 1). In particular, the figure plots the difference between CDS weekly spreads written in USD and EUR for a set of 14 Western European countries from September 2010 to May 2017.³

Rising euro and dollar CDS differentials: Umbrellas cost more when (and where) it’s raining

At the peak of the crisis in 2012, hedging in USD against the default of the PIIGS countries (Portugal, Ireland, Italy, and Spain)—but excluding Greece, a major outlier— would have cost about 100 bps more, on average, than a contract priced in EUR.

Trouble might be brewing once again. Since the end of 2014, buying protection in USD has become more expensive, as the widening orange area in Figure 1 shows. Moreover, the PIIGS (ex-Greece) countries seem to be driving this gap, as their average value lies at the top of the cross-section (black line). As point of comparison, the dashed line that plots the cross-sectional average gap for the rest of the European countries in the sample has remained relatively flat at around 10 bps.

A possible economic explanation for this differential lies in the fact that the currency value (EUR) appears strongly related to the default risk of the countries using it. Therefore, the widening trend that started in mid-2014 may signal increasing currency risk, probably associated with the risk of significant distress for the European Union as a whole.

The currency volatility risk premium—a measure of risk aversion

In support of this economic view, the gap between buying protection in USD and EUR appears to reflect investors’ compensation for systematic, nondiversifiable currency risk in Europe. In other words, this compensation measures the cost of insurance against fluctuations in the currency market, capturing the degree of market risk aversion.

Academics, among others, call this phenomenon the currency volatility risk premium (CVRP)—a measure of how much investors are willing to spend to insure their portfolio against currency fluctuations. Della Corte, Ramadorai, and Sarno (2016) provide a model-free measure of this cost (see Appendix).

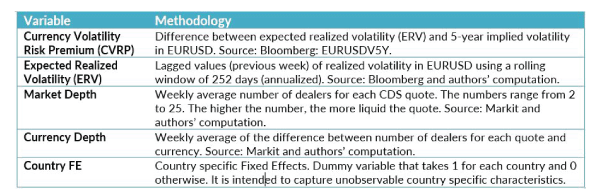

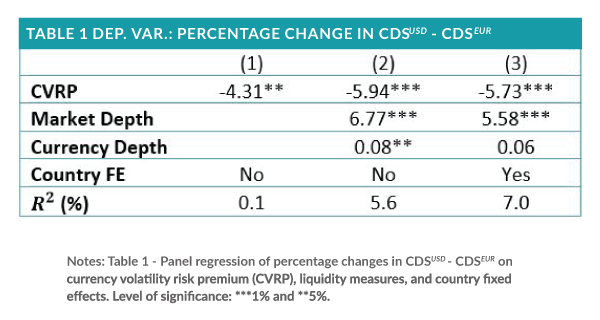

In seeking to explain such currency-related phenomena in sovereign credit markets, Table 1 reports the results of a panel regression of percentage changes in the difference of CDS priced in the two currencies on the volatility risk premium and several liquidity measures, such as market and currency depth, as well as country fixed effects (FE) (see Appendix for further explanation).

The results suggest that this currency risk persists even after controlling for the other potentially confounding factors. The negative sign of the currency volatility risk premium indicates that the difference between USD and EUR CDS spreads shrinks when currency risk is relatively cheap to buy (increasing CVRP)—i.e., when markets are pricing in less risk. Although this result appears to remain robust to the inclusion of market liquidity risk, currency liquidity risk, and country-related unobserved characteristics, most of the variation in the credit-currency gap still remains unexplained.

Potential implications for investors

It is hard to say whether investors would have felt less panicked in 1932 if they had entered into insurance contracts such as credit default swaps. However, the hybrid nature of these instruments, which bundle together default and currency risk, potentially makes the overall sovereign credit market more fragile as well as more informative on the underlying currency risk. Although credit-implied currency risk needs further exploration, investors may find it worthwhile to consider the increasing demand for foreign currency-CDS spreads in Europe as a signal of increasing currency risk and reallocate their portfolios accordingly

Appendix