The theater of Dionysus offered ancient Athenians a nearly ideal venue to watch dramatic tales unfold over multiple acts. The sad and sometimes tragic stories of Aeschylus, Sophocles, and Euripides held audiences’ attention, even when their conclusions seemed foregone well before the dénouement.

Modern Athens plays host to another tragedy, this one multi-authored by political leaders throughout Europe and at times watched by millions of spectators worldwide. Like its ancient predecessors, the current tragedy encompasses several acts. Yet unlike the performances in the Theatre of Dionysus, the modern audience seems to have left the building.

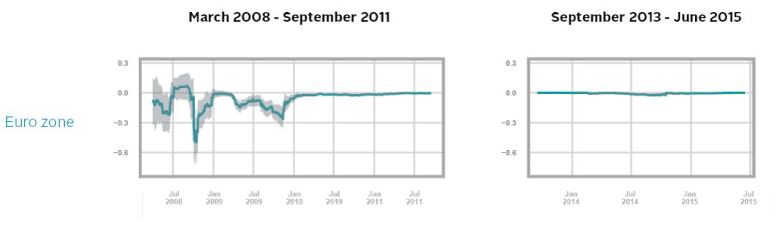

Muted market reactions to latest Greek crisis

Whereas previous acts that threatened to end in Greek default adversely dragged upon European and global equity markets as well as the euro exchange rate, the most recent dramatic flare-up in Greece seems to have had minimal effect on the market.

Rolling regression results show that equity and EUR/USD prices today are half as sensitive to changes in the probability of Greek default as they were in 2009-2010. Market participants might draw one of two conclusions from those results: either equity and FX market participants naively underestimate risk from Greece, or the conclusion to a play on a Greek default no longer matters (much) to markets outside of Greece.