Relative to developed markets, developing (emerging and frontier) markets have enjoyed 4.2x higher economic growth and 40% better equity returns over the past decade.1 Many economic forecasters still expect these developing markets to continue to grow faster than developed markets over the next decade, albeit with a smaller growth multiplier. This paper, Emerging and Frontier Market Equities as Asset Class(es), argues that investors should apply a healthy dose of caution when allocating capital to developing market equities.

Key historical sources of developing market returns may prove illusory

Historically, returns from investing in less developed economies have come from two sources: compensation for currency risk and unexpectedly high growth rates. Given the role that monetary policy plays in determining exchange rates, and the (arguably) elevated expectations (5+% per year) for developing world growth rates, these two sources of returns may become difficult to forecast and potentially illusory.

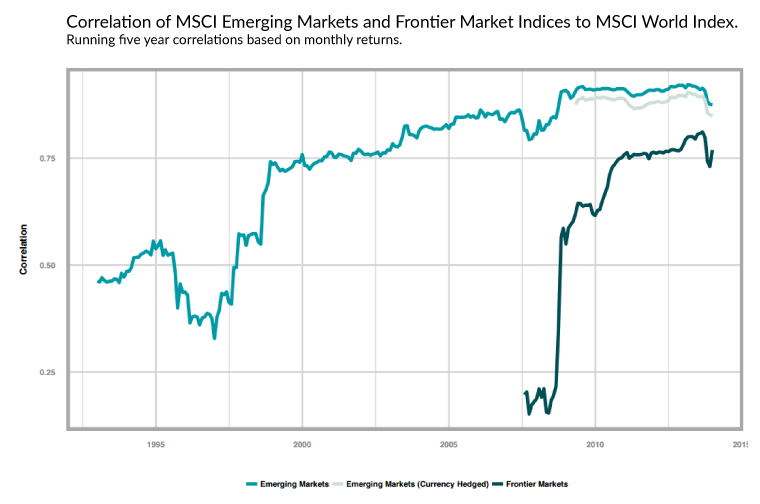

In addition, the diversification benefits from investing in emerging markets have declined over time, likely due in part to greater global integration of companies’ input and output markets.

On net, it seems that the portfolio benefits – in terms of both expected return and risk diversification – from investing in emerging and frontier market equities have diminished but not evaporated over time.